As an employee, don’t worry; your employer will still pay you for these hours. For freelancers or business owners, non-billable hours will help you increase your profits and benefit your business. This post will explain billable and non-billable hours, why you should automate this process, and how you can track billable hours using Hubstaff.

If you are still looking for the best way to track billable hours, you don’t want to miss Forecast’s massive Utilization report either. It automatically tallies up your billable hours from the timesheets, calculates utilization rates as well as tracks hours spent on non-billable work. The only thing you need to do to get this data is to make time registrations a staple in your routine.

Track all your billable hours and charge more

Look back at what you or your team have accomplished each day or week, especially if there is a large gap in time between projects or clients. Reviewing your progress can help point out any issues with tracking not only your hours but also your team’s. Tracking billable hours allows you and your team to have a clear picture of how much time is spent on each task. This way, you can identify where you or your team can improve and how to maximize earning potential. Billable hours are the bread and butter of professional services firms. Unlike manufacturing, which sells a product, or retail, which sells a service, professional services firms sell the time they spend working.

- It’s fine to have queries, but employees might end up wasting time.

- Tracking billable hours is necessary for specific projects and industries.

- You can speak to experts, consult friends, or search on the internet to be in the know of the average rates in your service industry.

- Master law office management with our ultimate guide including best practices for leveraging the technology to save your time and manage law firm effectively.

- This means you’ll save time, which translates into enhanced billable hours.

Once you know what you’d like to charge the client, measure this against the work you’ll deliver. In the client’s case, you can also identify what their cost is to you. It’s used by major companies as well as small-medium businesses like to optimize their business efficiency. You can also save a report and share it with your client so they can track costs in real time.

Track all the billable hours

Additionally, it also adds up to the absence of those who, just like Jane from the previous example, decided to take some more time off. The 8 hours spent on public holidays will need to be deducted from their billable hours, too. The advantage of billing time to clients with set billing rates is that it gives your client a clear picture of how you spent your time and why it is worth their money. Tracking hours you’re billing also ensures you will be paid for any overtime hours worked.

When it is time for a raise or promotion, this information can ensure that you’re getting paid fairly for your efforts. Non-billable work also means lower profits and higher labor costs. When your employees spend most of their time on Billable hours non-billable activities, it’s hard to grow your business without adding more people (which increases fixed costs). Content writers, graphic designers, business consulters, and lawyers will most likely work with this billing system.

PracticePanther

For example, if you are a lawyer at a firm, you may not necessarily be paid according to your billable hours. After you’ve divided your salary by the number of hours, increase this figure by a little to account for the time you may spend on non-billable tasks. You should factor in your lifestyle requirements and things like vacation, personal days, and emergencies. Once you have separated billable from non-billable time, you can set hourly rates so Clockify can calculate how much money you’ve earned.

There are many ways for you to increase your billable hours smartly. Knowing the difference between billable and non-billable hours is crucial for good management. This article will explain more in-depth what billable hours are, how you can track them, and why they are so crucial for your business. These are some benefits of the billable hour model to consulting firms. To achieve the target in the billable hour model, the employees are often made to work long hours.

Rarely—if ever—do you find a lawyer who charges clients based on how many documents they inspect or how many words they write. Billing based on time is more efficient for lawyers, and therefore, most lawyers in the industry practice this method of charging clients. Billable hours are crucial for consulting firms to measure their productivity and revenue. They represent the time consultants spend working directly on client projects instead of non-billable activities such as business development, training, or administrative tasks. It’s worth noting that these figures are general guidelines and can vary significantly depending on the specific law firm, its practice area, and the location.

Allowing for vacations and holidays, this breaks down to a minimum of 37 billable hours per week. Thus, assuming that a paralegal works a standard 40-hour week, this leaves only three hours per week for non-billable activities. That is because the number of billable hours in the project is known from the beginning and stated in a contract. Just like in the previous example, we will calculate the value for a typical company working Monday to Friday for 8 hours a day. This time, however, we will choose a random month for a calculation, as the equation will differ depending on the time period of choice. In our case, we will analyze the billable hours for September 2022.

What are billable hours and what’s the best way to track them?

Last but not least, time trackers also solve the problems with billing. Software such as Primetric is combined with financials, allowing for instant creation of financial statements, as well as accounting. To add to that, all of these things happen without any human support or calculations – the results of these actions are visible in the system in an instant. For the sake of simplicity, we will assume that the company we calculate this example for works Monday to Friday, 8 hours a day, for 260 days a year.

In this article, we’re going to discuss everything you need to know about billable hours and the tools you need to start optimizing outputs as soon as possible. Prove how much time you spend working, so it can be easy to negotiate a higher salary or billing rate. If you have a good automated invoicing system, you will stay consistent and thus avoid missing invoices. It is standard practice to send invoices monthly but for projects that need more resources, you can work out a bi-weekly schedule with your client. It is best to track working hours by project separately, even if the different projects belong to one client.

If you are a freelancer and you forget to bill hours, or if your team members get distracted and forget to bill their hours until the end of the day or the week, time may get lost. Depending on requirements, you may also need to consider the opposite — the issue of billable rate overrun. The overrun rate means you have exceeded the allotted hours a client has allowed for a project. But how productive should you be in terms of client work, especially when you’ve got to pay the bills?

They’ve Got Next: The 40 Under 40 – Abigail Gregor of Ropes & Gray – Bloomberg Law

They’ve Got Next: The 40 Under 40 – Abigail Gregor of Ropes & Gray.

Posted: Thu, 27 Jul 2023 07:00:00 GMT [source]

If lawyer hours in the law firm didn’t include enough billable hours, equity partners could face a serious decline in their compensation. By knowing exactly which tasks constitute billable hours and how to keep track, you’ll be ready and set to optimize everything from workflows to invoicing. Legal professionals, for example, are sometimes required to work a minimum number of billable hours. How many billable hours you aim for will depend on your industry and professional position. It is also possible to monitor the utilization rate of employees working billable hours. Maintaining a template to track your billable hours accurately is also a useful idea.

Billable tasks

Reducing the administrative workload, for example by making payment reminders automated, can be a huge time saver. You can also digitize your documentation whenever possible to make finding what you need as easy as possible. This is the time that is actually being dedicated to work for a given client or on a particular project.

Continue reading to understand what is billable work, how to calculate billable hours, and how to keep track of the work for invoicing your clients (and following up with them as necessary). Additionally, tracking billable hours provides the foundation for compensation and incentive structures. It enables firms to identify and reward consultants based on their productivity and contribution to the firm’s success. It’s important to note that there is no standard or set number of billable hours for paralegals across the industry.

- Once you type ‘in’, the software will begin to track your time for that specific project.

- To make sure you don’t overlook any of your billable hours, track them in real time.

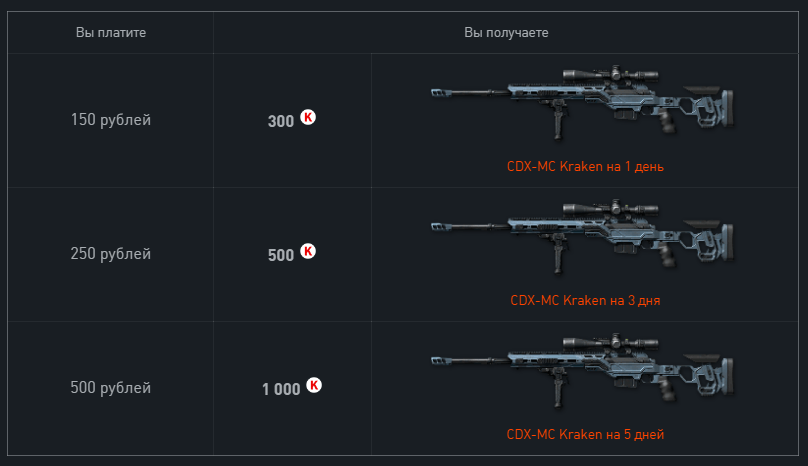

- Before a business, agency, or freelancer starts working with a client, they must first come to an agreement on the rate charged per hour.

- It’s not uncommon for employees to have to work overtime or skip lunch breaks just to get their billable work done.

- Sometimes a service provider may argue against a cap, claiming that they do not know how long a project is going to take.

But all those small increments of billable time can add up to a significant number of billable hours over the span of an entire project. Track every minute you spend working on a client’s project to increase your billable hours. Because developing a manual time log can be cumbersome, you can also track your billable hours digitally.

If this process is new to you, here’s what you should know about billable vs. non-billable time. The Rize app monitors your activity in real time, making it easy to see how you’re spending your day and to tabulate your billable tasks. Both types of work are vital for running your small business or freelance operation, but it’s essential to understand how to balance your time between billable and non-billable hours. Billable hours are how you get paid but performing non-billable work is also critical for running your business and growing your client base.

For example, a project manager might have a rate of $1,000 a day but employees assigned lower rates may do much of the work for a given project. The client may be charged a combined rate based on the billable hours of all employees involved in the project. Billable hours are the amounts of an employee’s work time that can be charged to a client. Employers charge clients at sometimes varying rates for different employees. For example, Forecast is an all-in-one tool you can use for project management, invoicing, time tracking, and administrative work.